The Ghanaian business community will perish as a result of the three new taxes that President Nana Addo Dankwa Akufo-Addo has approved, according to the Food and Beverages Association of Ghana (FABAG).

The Association claims that the President’s approval of the tax bill has caused great concern about the possibility of crippling businesses nationwide.

The three taxes, according to John Awuni, Executive Chairman of FABAG, are extremely disappointing because they have effectively given Ghanaian businesses the death warrant.

According to him, the recently signed taxes are a total denial of the government’s 1D1F campaign platform.

Because you can’t claim that you are encouraging industry while simultaneously introducing taxes that will kill it, the government has shot itself in the foot.

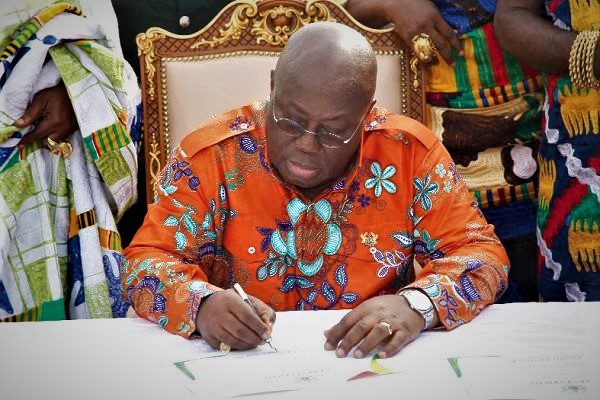

READ ALSO: Prez Akufo-Addo Finally Assents 3 New Tax Bills Into Law

He said that the same issues with industry development still exist and that it is shocking that there are so many taxes, all of which are essentially fatal.

The three new tax bills recently passed by Parliament on Friday, March 31, 2023, were signed into law by President Nana Addo Dankwa Akufo-Addo on Monday, April 17, 2023.

The Excise Duty Amendment Bill 2022, the Growth and Sustainability Levy Bill, and the Income Tax Amendment Bill 2022 are the three new taxes.

The three new taxes that the government has imposed have prompted reactions from Ghanaians.

Critics fear that the bill will force small business owners and those with lower incomes out of the digital economy.

The estimated annual revenue from the bills is GH4 billion. Following the shocks of COVID-19 and the Russia-Ukraine war, the government claimed that the tax bills would boost Ghana’s fiscal position by bolstering domestic revenue.

An MP from the majority had a near-fatal accident on his way to the House, but the bills were still passed despite the minority’s earlier communication of opposition.