The Feds Cut Rate First Time In 4 Years Everything To Know

The Federal Reserve has made a significant move by cutting interest rates for the first time in over four years. This decision, announced on September 18, 2024, marks a pivotal moment in the U.S. economic landscape. Here’s a detailed look at what this means and its potential impacts.

Why the Rate Cut?

The Federal Reserve’s decision to cut interest rates comes after a period of high inflation and economic uncertainty. Over the past few years, the Fed raised rates multiple times to combat inflation, which peaked at 9.1% in June 2022. However, with inflation now down to 2.5%, close to the Fed’s target of 2%, the focus has shifted to supporting economic growth and a weakening job market1.

The Details of the Rate Cut

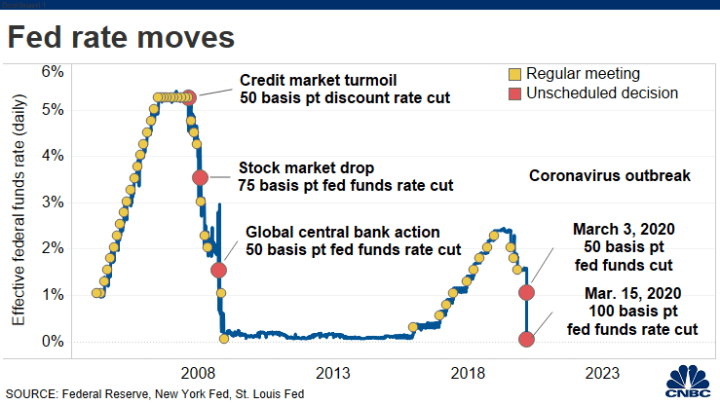

The Fed has reduced its benchmark interest rate by 0.5 percentage points, bringing it down to a range of 4.75% to 5%2. This move is expected to be the first in a series of rate cuts that will extend into 20251. The decision aims to lower borrowing costs for consumers and businesses, potentially boosting spending and investment.

Impacts on Consumers and Businesses

- Lower Borrowing Costs: The rate cut will lead to lower interest rates on mortgages, auto loans, and credit cards. This can make it cheaper for consumers to finance big purchases and also for businesses to invest in growth3.

- Refinancing Opportunities: Homeowners and businesses with existing loans may find it advantageous to refinance at lower rates, reducing their monthly payments and overall interest costs3.

- Also Stock Market Reaction: Lower interest rates often lead to higher stock prices. As borrowing costs decrease and corporate profits potentially increase. This can be beneficial for investors1.

- Economic Growth: By making borrowing cheaper, the Fed hopes to stimulate economic activity, support job creation, and avoid a sharp recession1.

The Bigger Picture

This rate cut is part of the Fed’s broader strategy to achieve a “soft landing” for the economy—curbing inflation without triggering a significant downturn1. While the move has been welcomed by many, it also comes with risks. Lower rates can also lead to higher asset prices and potentially create bubbles in markets like real estate and stocks.

Looking Ahead

The Fed’s decision signals a shift in monetary policy, with more rate cuts likely on the horizon. This approach aims to balance the dual mandate of promoting maximum employment and also stabilizing prices. As the economic landscape evolves, the Fed will continue to monitor key indicators and adjust its policies accordingly.