Gold Price Shoots Up To 1 Million Dollars

)

The financial world is abuzz with the latest news: gold prices have skyrocketed, reaching an unprecedented $1 million per ounce. This historic surge has left investors and market analysts scrambling to understand the factors driving this dramatic increase and its potential implications. Here’s a comprehensive look at this extraordinary event.

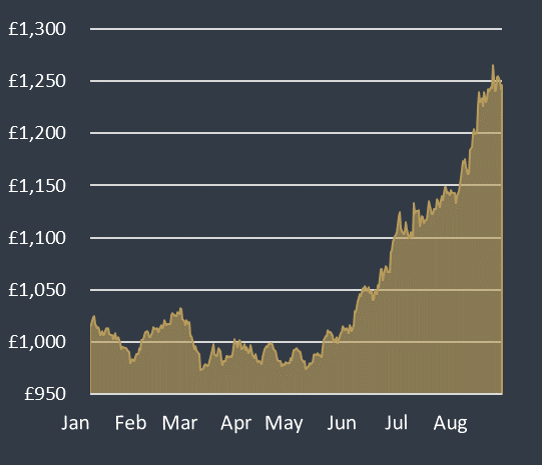

As of now, gold prices have reached a record high of over $2,500 per ounce12. This increase is driven by factors such as economic uncertainty, expectations of Federal Reserve interest rate cuts, and strong demand from investors and central banks12.

To put it into perspective, a standard gold bar, which typically weighs about 400 troy ounces, is now valued at over $1 million12. This makes gold an attractive investment option for many, especially during times of economic instability.

The Surge in Gold Prices

Gold has always been considered a safe-haven asset especially during times of economic uncertainty.However, the recent surge to $1 million per ounce is beyond anything seen before.

- Economic Uncertainty: Global economic instability, driven by geopolitical tensions, inflation fears, and market volatility, has led investors to flock to gold as a secure investment.

- Central Bank Policies: Central banks around the world have been increasing their gold reserves, further driving up demand and prices.

- Supply Constraints: Limited new gold discoveries and the challenges of mining have constrained supply, contributing to the price surge.

Historical Context

To understand the significance of this price surge, it’s essential to look at gold’s historical performance. The current price of $1 million per ounce marks a dramatic departure from historical norms, also reflecting unprecedented market conditions.

Implications for Investors

The surge in gold prices has several implications for investors:

- Wealth Preservation: For those who already hold gold, this price increase represents a significant boost in wealth.

- Investment Opportunities: New investors may see gold as an attractive option. But they must also consider the risks associated with buying at such high prices.

- Market Volatility: The dramatic rise in gold prices could lead to increased market volatility. Also affecting other asset classes and investment strategies.

Economic Impact

The impact of gold reaching $1 million per ounce extends beyond individual investors. It has broader economic implications:

- Currency Valuations: Countries with significant gold reserves may see their currencies strengthen, while those without may face devaluation pressures.

- Also Inflation: The surge in gold prices could contribute to inflationary pressures. As the cost of goods and services linked to gold increases.

- Mining Industry: Gold mining companies may experience a boom. But they also face challenges related to increased operational costs and environmental concerns.