AMD and Nvidia Stocks Experience Drop After AMD’s Guidance and Outlook

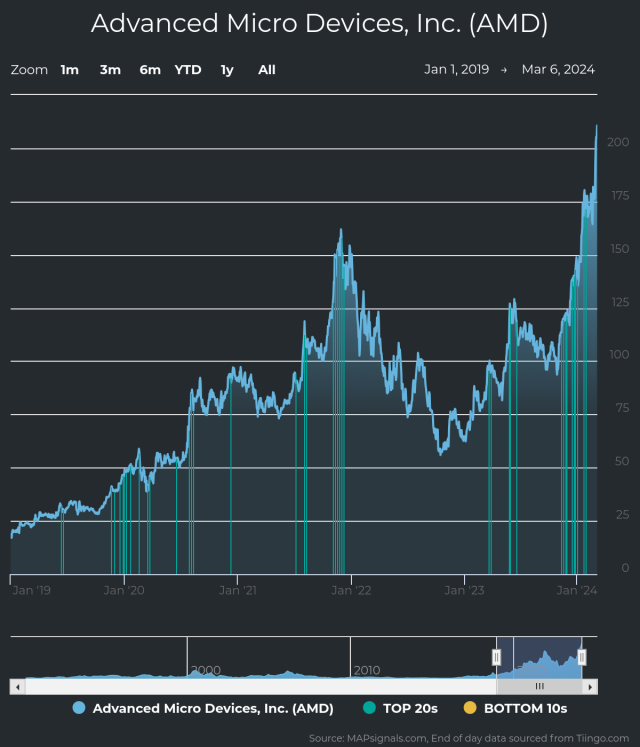

In a surprising turn of events, AMD’s stock took a nosedive after the company’s latest earnings report. Despite year-over-year revenue and earnings growth, AMD fell short of expectations for the previous quarter. The Data Center segment performed well, driven by record sales of the MI300 AI accelerators and EPYC server processors. However, weakness in the Gaming and Embedded segments offset these gains. Nvidia, a leading graphics processing unit (GPU) manufacturer, saw its stock retreat after AMD’s earnings report. Here’s what happened:

- Advanced Micro Devices (AMD) disappointed investors with its tepid guidance following its quarterly earnings report.

- While AMD’s year-over-year revenue and earnings increased, they fell short of the previous quarter.

- Strong performance in the Data Center segment, driven by record sales of the MI300 AI accelerators and EPYC server processors, couldn’t fully offset weakness in the Gaming and Embedded segments.

- AMD raised its 2024 revenue target for the MI300 to “at least $4 billion,” up from $3.5 billion, but some on Wall Street were expecting higher guidance for the product.

- As a result, AMD stock tumbled more than 9% to $143.21.

Industry Competition

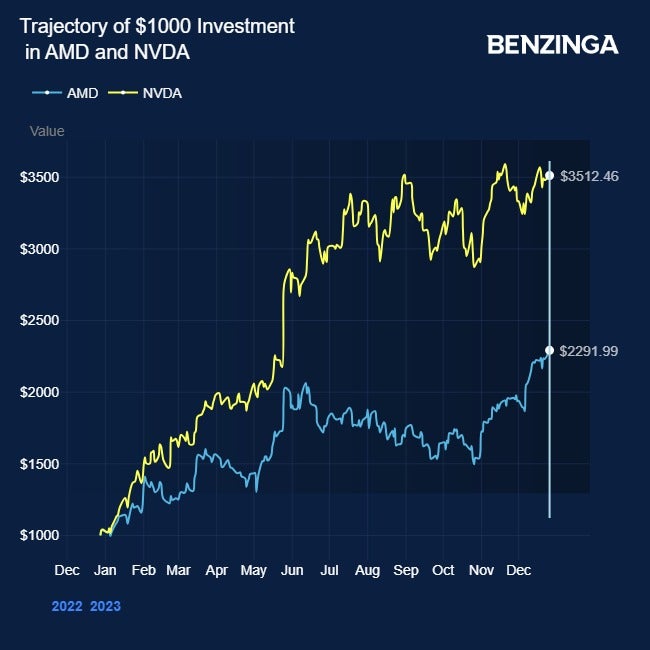

The AI chip market is highly competitive, and both AMD and Nvidia are vying for dominance. Investors are closely monitoring how these companies position themselves in this rapidly evolving landscape.

Nvidia Stock Retreats After Rival AMD’s Guidance:

- Nvidia (NVDA) stock also experienced a decline after AMD’s guidance update.

- Investors were disappointed by AMD’s outlook, which impacted the broader semiconductor sector.

- In midday trading, Nvidia stock retreated roughly 5% to $821.39.

Overall Impact on Semiconductor Stocks:

- The Philadelphia Semiconductor Index (SOX), which includes the 30 largest semiconductor stocks traded in the U.S., slid 3.9%.

- Wireless-chip maker Skyworks Solutions (SWKS) also reported quarterly results below expectations, causing its stock to plummet 15.4% to $90.13.

- Skyworks is heavily exposed to the declining smartphone market

Analyst:

While Nvidia faces short-term pressure due to AMD’s guidance update, it’s essential to remember that the AI market is still expanding. Both companies have unique strengths, and their long-term strategies will determine their success.

Keep an eye on developments in the semiconductor sector. For now, Nvidia investors should stay informed and consider the broader industry trends.