Chevron Stock: About, what they Do, Stock Price, Founders, CEO, CFO, Revenue, Founded, President, Analyst Forecast, what’s New, Updates And Everything To Know

About Chevron:

-

- Chevron, an oil supermajor, has a rich history dating back to 1879. From its modest beginnings in California, it has evolved into a global energy industry leader. Let’s explore why Chevron stock is also worth considering for investors.

- Their businesses span from upstream (drilling) through midstream (pipelines) to also downstream (chemical and refining).

Business Operations:

- Energy Value Chain: Chevron operates throughout the energy value chain:

- Upstream (Drilling): Exploration and production of oil and natural gas.

- Also Midstream (Pipelines): Transporting energy resources.

- Downstream (Chemical and Refining): Also Processing and selling refined products.

- Hydrogen Initiative: Chevron aims to increase its presence in the hydrogen landscape, also targeting annual hydrogen production of 150,000 metric tons by 2030.

CEO:

- Michael K. (Mike) Wirth has been the Chairman of the Board and also CEO of Chevron Corporation since 2018.

Revenue:

- Chevron is one of the largest companies globally and ranked 10th on the Fortune 500 in 2023.

What’s New:

- Chevron is expanding beyond fossil fuels and also targeting annual hydrogen production of 150,000 metric tons by 2030.

Company History:

-

-

- In 1879, explorers and merchants established the Pacific Coast Oil Co. in California.

- The company’s first successful oil well, Pico No. 4, also marked California’s earliest commercial oil discovery.

- Over the years, Chevron also retained its founders’ spirit, innovation, and perseverance.

-

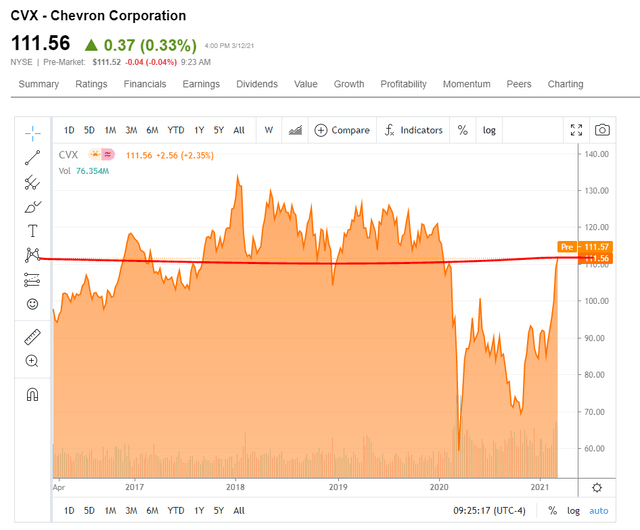

Current Stock Price (as of June 28, 2024):

-

- $156.45 per share.

- 52-Week Range: $139.62 – $171.70.

Dividends and Yield:

-

- Chevron has increased its dividend for 37 consecutive years.

- The current dividend yield is approximately 4.03%.

Investment Considerations:

-

- Chevron’s history of dividend raises, low production costs, and also diversification make it a foundational oil and gas stock worth owning for the long term.

- The company is also exploring opportunities in hydrogen production.

Investment Steps:

- Open a Brokerage Account: Choose a platform like Fidelity for zero-commission online stock trades.

- Also Determine Your Budget: Invest an amount that aligns with your financial situation.

- Research: Understand energy stocks and also Chevron’s position.

- And also Place an Order: Buy Chevron stock (ticker: CVX).