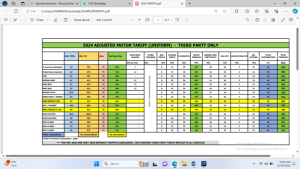

The cost of third-party insurance is expected to increase as of January 1, 2024.

This came about following the insurance companies’ receipt of authorization to implement these modifications from the National Insurance Commission.

Therefore, third-party insurance for private automobiles is estimated to cost ¢482, while business taxis would only pay ¢437.

Conversely, private corporations will pay ¢482, while those who rent cars will pay ¥652. Additionally, motorbikes should be paid ¢252.

Complying with new tariffs and possible sanctions

In a letter seen by Joy Business, the Ghana Insurers Association cautioned its members to closely adhere to the established rates; failing to do so will result in the necessary fines from the NIC.

The NIC also informed Joy Business that it is keeping a careful eye on the new tariffs to make sure they comply with the permitted amounts.

It further stated that businesses that disregard the established rates will face consequences without hesitation.

Additionally, the Ghana Insurers Association informed its members that the pre-and post-2020 pricing will no longer be accepted.

Joy Business is aware that the ¥3000 and ¥5000 capacity implications have been eliminated and will not affect the premium collections.

Reasons behind increment

In a statement to the insurance companies, the Ghana Insurers Association stated that the increase will support the settlement of valid claims by strengthening the financial condition of the insurance companies.

Third-party insurance premium increase and VAT impact on non-life insurance products

Joy Business is aware that the Value Added Tax (VAT) Amendment Bill, which was approved by Parliament last week and might impose a 21.9% VAT on all non-life insurance goods, does not take the increase in third-party insurance premiums into account. As a result, insurance rates will have increased by over 30%.

The date on which the five tax bills will go into effect has not yet been announced to the public by the Ghana Revenue Authority. However, the insurance companies have already made these changes, except that they have applied a 21.9% VAT on non-life insurance products and activities.

This could imply that insurance premiums would increase once more when the GRA begins to implement the VAT Amendment Bill.