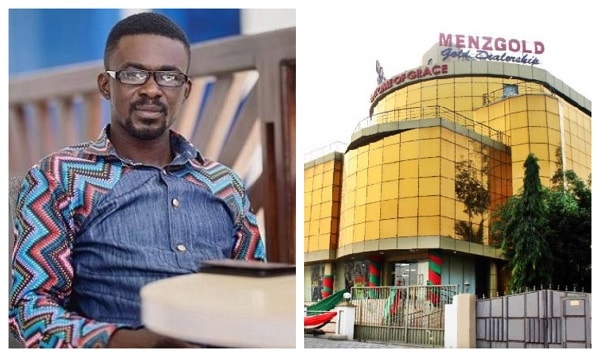

According to statements from the CEO of the former gold trading company Menzgold, more than 5000 customers have had their financial obligations met.

In a Twitter conversation about recent problems with customer reimbursements, the CEO of the gold dealership firm mentioned that payments have been finished for 5000 clients.

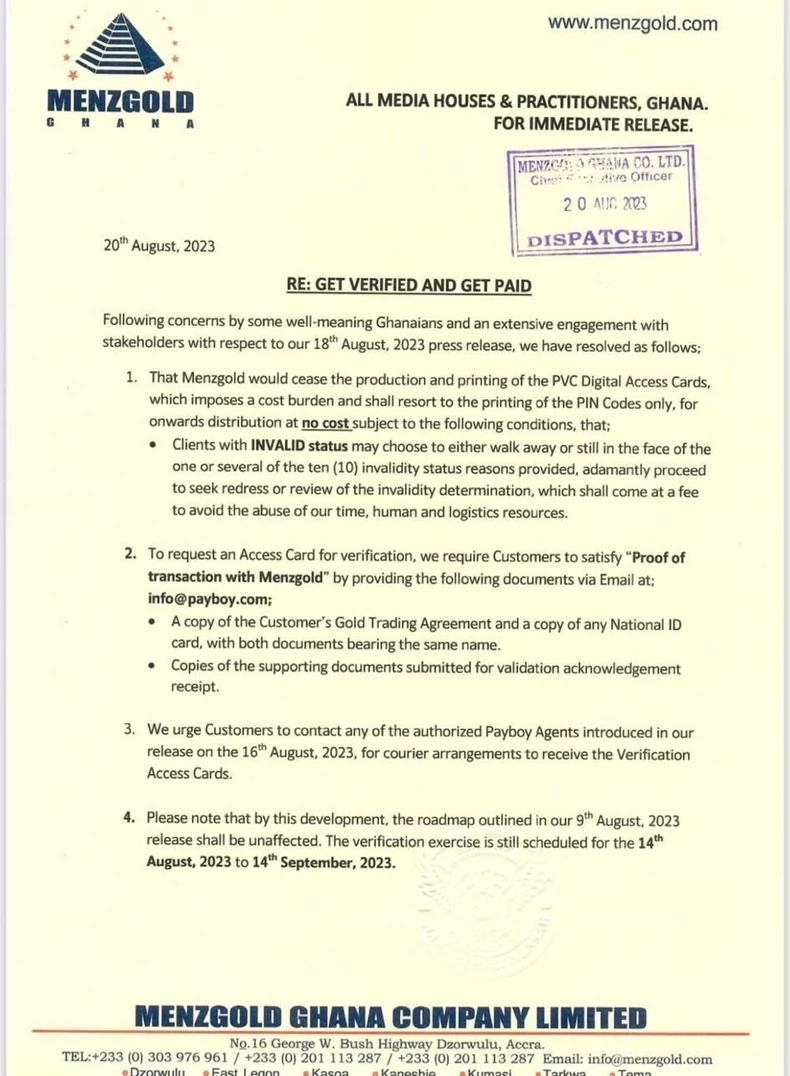

Initial customer requests for all required documentation were made by the business to speed up the payment validation process.

However, the company explained in a later communication that a sizable portion of submitted claims had discrepancies, making 60% of the claims ineligible for settlement.

The now-defunct business had also suggested that customers with funds locked up enroll for a fee of 650 cedis to find out if they qualified for reimbursements.

READ ALSO: Newspaper Headlines: Monday, August 21, 2023 – InsightNewsgh.com

Concerns have been raised about the recent statement release regarding the fee assessed to determine payment eligibility.

The management of the gold dealership company is being urged by customers to review and modify the fee structure.

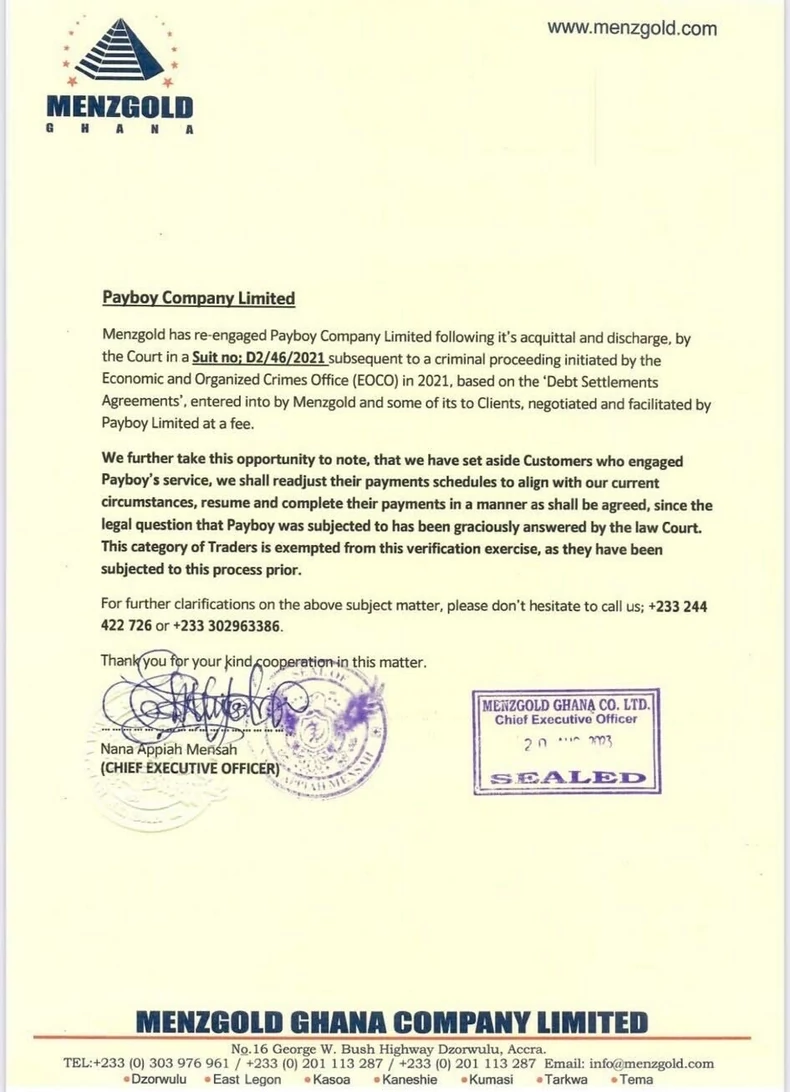

In response to the issues, the management wrote in a letter dated August 20 2023 and signed by the CEO Nana Appiah Mensah, “To request an Access Card for verification, we require Customers to satisfy “Proof of transaction with Menzgold” by providing the following documents via Email at info@payboy.com

“A copy of the Customer’s Gold Trading Agreement and a copy of any National ID card, with both documents bearing the same name”

“Copies of the supporting documents were submitted for validation acknowledgment receipt”

“We urge Customers to contact any of the authorized Payboy Agents introduced in our release on 16 August 2023, for courier arrangements to receive the Verification Access Cards.”

Since the Securities and Exchange Commission (SEC) ordered the closure of the company, Menzgold’s customers have had to deal with locked investments.

Without a trial taking place, the CEO has appeared in court more than 30 times.